people's pension higher rate tax relief

Tax relief is paid on your pension contributions at the highest rate of income tax you pay. This means that you receive tax relief at the highest rate of tax that you pay.

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Higher-rate tax relief was due to be taken away from those earning over 150000 from April next year.

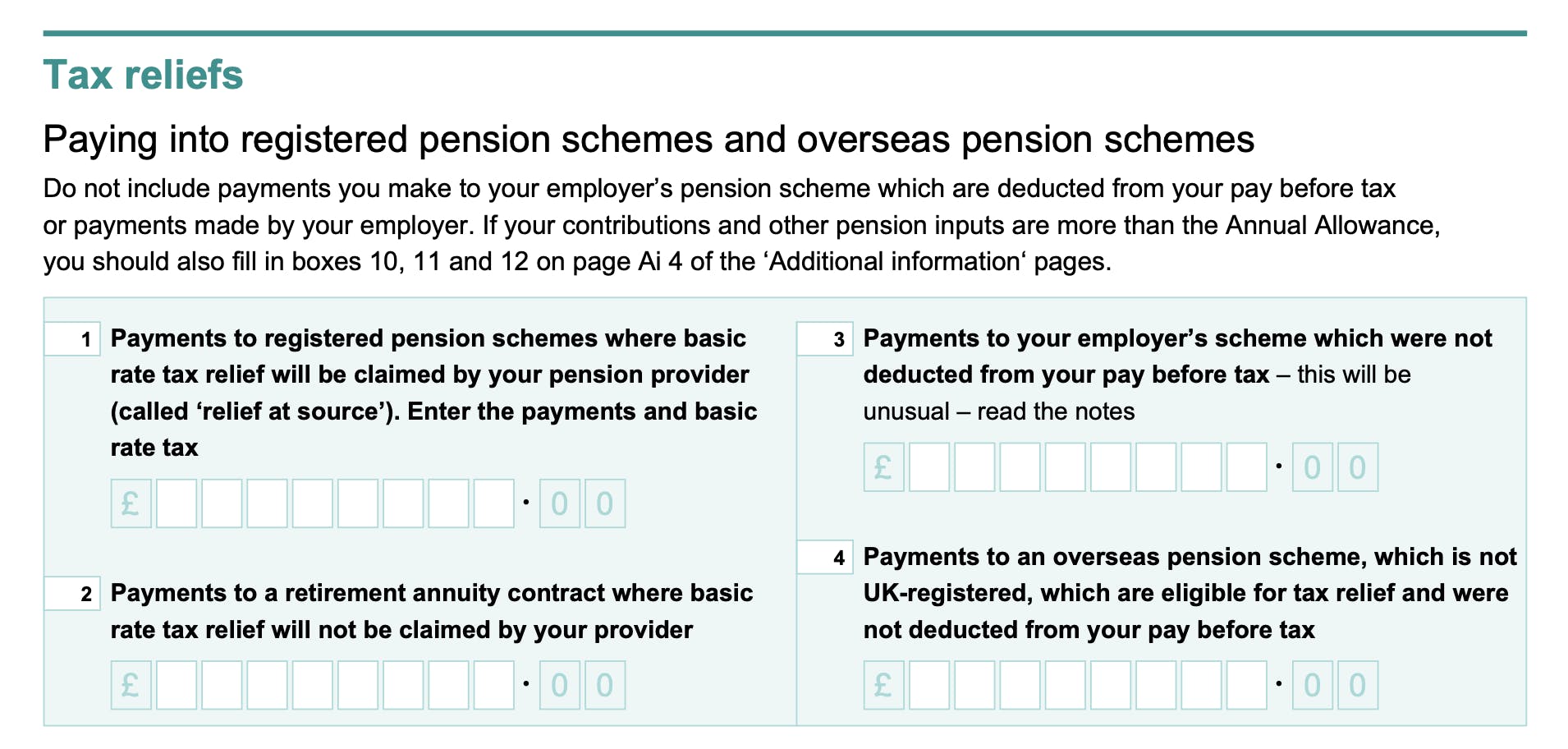

. Your employer deducts your contributions from your pay before they calculate the tax due from your pay. There are three different ways that you may receive tax relief on your contributions. Under HM Revenue Customs HMRC rules each tax year you can receive tax relief at your highest marginal rate of tax on 100 of your relevant UK earnings up to the annual allowance or 3600 gross 2880 net whichever is higher.

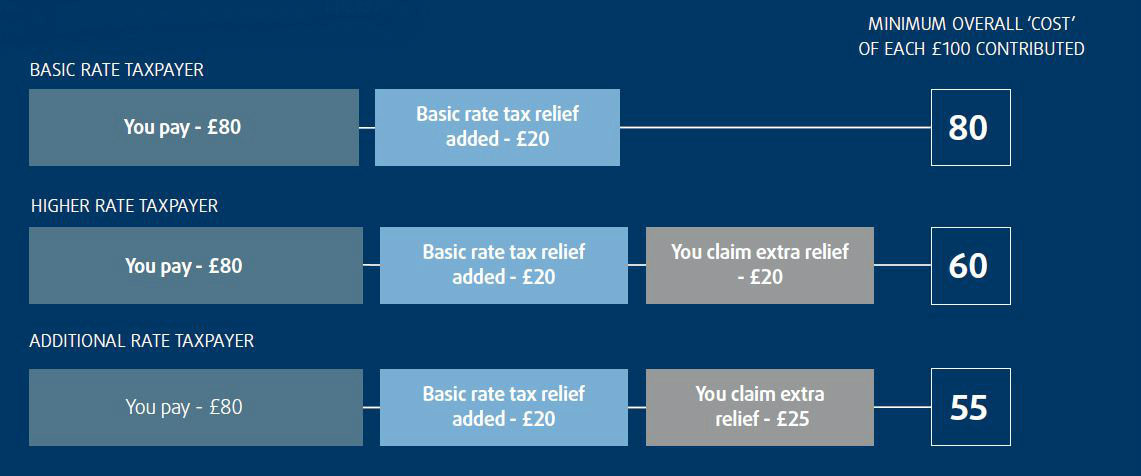

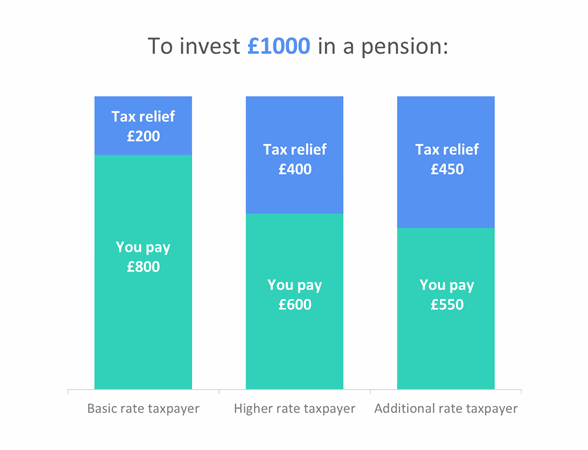

There is no extra. If you pay tax at 20 no further relief is due to you. A basic rate tax relief of 20 is automatically applied on the whole amount.

This means that for every 80p of pension contributions you make your basic rate band is extended by 1. Basic rate taxpayers pay 20 income tax and get 20 pension tax relief. Pension tax relief is equivalent to.

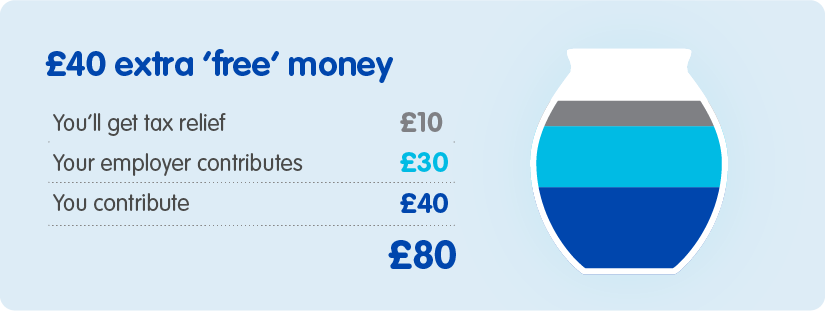

Contribute 100 into your pension the government will automatically add 25 themselves via tax relief. Relief at source means your contributions are taken from your pay after your wages are taxed. Intermediate rate taxpayers pay 21 income tax and can claim 21 pension tax relief.

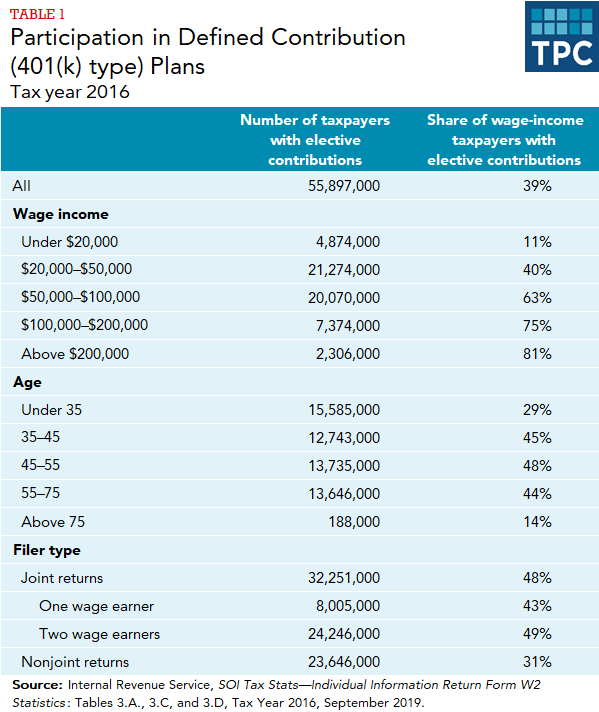

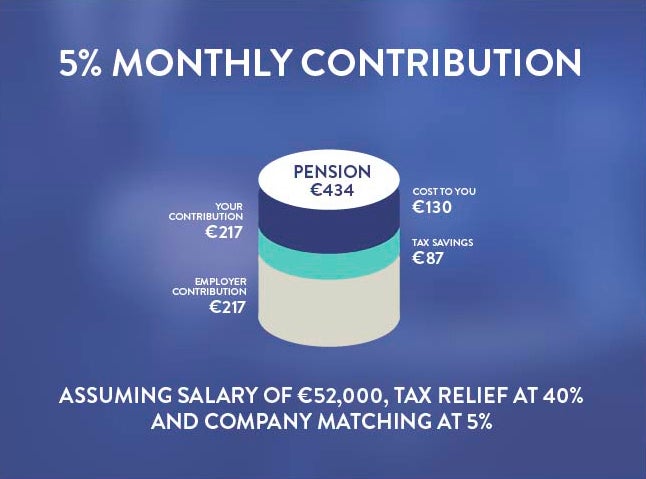

Top rate taxpayers pay 46 income tax and can claim 46 pension tax relief. You can claim an extra 20 tax relief on 30000 the amount you paid higher rate tax on through your return or by writing to the tax office. The people in these DC schemes earn an average of 51580 a year and pay an average of 425 each month into their scheme on top of which they automatically get 20 per cent tax relief.

Basic-rate taxpayers get 20 pension tax relief. Your pension pot will automatically receive tax relief of either 40 or 50. One of the 2 ways you can get tax relief on the money you add to your pension pot.

For most people this works out as 25 on top of whatever you pay in. And youll find useful information on our website. It comes on top of the 20 basic-rate tax refund the taxman pays directly into your pension plan.

And with income tax thresholds freezing until 2026 after a rise in April an estimated one million taxpayers will be drawn into these bands over the next five years which means even more people will likely fail to claim relief owed. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. If youre a higher earner you may be able to claim even more back.

Relevant UK earnings are usually those earnings which are subject to UK income tax. Higher rate taxpayers only need to pay 60 to get the same 100 retirement pot saving. Higher-rate taxpayers pay 41 income tax and can claim 41 pension tax relief.

20 of the total contributions for basic rate taxpayers earning up to 50000 per year 40 of the total contributions for higher rate taxpayers earning between 50001 and 150000 per year. Prudentials research is based on figures from HMRC that 55 per cent of the 900000 higher rate taxpayers in the UK contribute to defined contribution DC pension schemes. We call this method the net tax basis as your contributions are taken from your.

Specifically the amount of extra tax relief you can claim depends on how much you earn over the higher rate tax band currently 50270. Put simply basic rate tax payers need to contribute just 80 to get 100 in their pension. 1 up to the amount of any income you have paid 21 tax.

Then we automatically claim tax relief for you adding the basic tax rate of 20 to your pension contributions. Higher-rate and additional-rate taxpayers are entitled to tax relief on their pension contributions at 40 and 45 respectively but around. Additional-rate taxpayers can claim 45 pension tax relief.

Higher-rate tax relief is the extra 20 tax refund you receive in respect of your pension contributions when you submit your tax return. Lets look at an example of how this works in practice. When you get tax relief on your pension some of the money that you would have paid in tax goes into your pension pot instead.

This is called a net pay arrangement. Higher-rate taxpayers can claim 40 pension tax relief. However people in group stakeholder pension schemes group personal pension schemes and personal pension schemes that they pay into privately will have to claim the 20 or 30 extra tax relief that you are owed from the government.

You can find more information about tax relief on wwwgovuktax-on-your-private-pensionpension-tax-relief. If youre making contributions into a private pension additional tax relief is given by extending your basic rate band. You can claim 20 extra tax relief on earnings you pay 40 tax on or 25 extra tax relief on earnings you pay 45 tax on.

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk

What Are Defined Contribution Retirement Plans Tax Policy Center

Updated Pension Tax Relief Cuts A Brief History

How Pension Tax Relief Works And How To Claim It Wealthify Com

Sipp Tax Relief I How Sipp Tax Relief Works Interactive Investor

Pension Contributions And Tax Relief For Limited Company Directors

Opting Out The People S Pension

California Tax Relief What S In The Deal Calmatters

How To Add Pension Contributions To Your Self Assessment Tax Return

Higher Income Tax How To Claim Pension Tax Relief Extra 20 Boost Youtube

North Carolina Providing Broad Based Tax Relief Grant Thornton

How Do Pensions Work Moneybox Save And Invest

Tax Relief On Additional Voluntary Contributions

Hogan And Legislative Leaders Announce Agreement On Tax Relief 2023 Spending Maryland Matters

Your Handy Guide To Company Pensions

Employee Tax Relief Brightpay Documentation

2022 State Tax Reform State Tax Relief Rebate Checks